- Awara

- July 12, 2016

- 3254

Statutory Interest: How to Avoid Risks

It has been exactly one year since a new rule appeared in the Civil Code, consolidating the concept of “statutory interest” (Art. 317.1 of the Civil Code). This situation has caused much worry among business participants, mainly due to the lack of general legal practice on this issue. We have tried to find out what changes have occurred in recent years in relation to “statutory interest”, and how business has adapted to the new realities.

What is “statutory interest“?

History of the question.

Since June 1, 2015, a number of changes have been introduced into the Civil Code. In particular, one of the most controversial changes was the rule in Article 317.1 on statutory interest. According to paragraph 1 of Article 317.1 of the Civil Code, “unless otherwise provided by law or contract, the creditor under a monetary obligation, the parties to which are commercial organizations, is entitled to receive from the debtor interest on the debt for the period of utilization of the funds. In the absence in the agreement of terms regarding the amount of interest, its amount is determined by the Bank of Russia refinancing rate in effect during the relevant periods (statutory interest).”

The conditions for accrual of statutory interest are as follows:

- the obligation of the parties must be monetary;

- the parties to the obligation must be commercial organizations;

- nothing is provided otherwise by law statute or contract (in particular, in the contract the right to receive statutory interest must not be ruled out);

- specific rules for the collection of interest must not apply to relations between the parties to the obligation (for example, among the provisions on purchase and sale there is para. 4 of Art. 488 of the Civil Code, to which Art. 317.1 of the Civil Code does not apply);

- the parties to the obligation did not agree on terms of commercial credit.

The parties may establish the amount of interest in the contract. If they do not, it will be equal to the refinancing rate of the Bank of Russia, in effect during the relevant periods (statutory interest).

Please note that in case of an advance (pre-payment) received from the buyer under a supply contract, a monetary obligation does not arise; therefore, Article 317.1 of the Civil Code does not apply (Russian Ministry of Finance Letter dated 09.12.2015 N 03-03-RH / 67486).

The mechanism of “statutory interest” can be illustrated by the following example:

Between two commercial organizations (A and B) a contract for the supply of goods is entered into, with the condition of payment within 30 calendar days from the date of delivery of the goods. On the 1st day of the month the buyer (company A) receives goods, and already on the 2nd and up to the 31st (or up to another day of actual payment, within the prescribed 30-day period) interest accrues per Art. 317.1 of the Civil Code, due to be paid to the seller (company B). If the buyer (company A) does not fulfill the obligation to pay within the specified period of time (i.e., within 30 calendar days from the date of delivery of the goods), the creditor has the right to require additional payment of interest for delay in fulfilling the obligation under Art. 395 of the Civil Code.

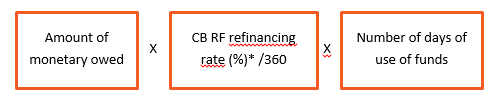

The amount of “statutory interest” is calculated using the following formula:

*On June 14, 2016, the CB RF refinancing rate was 10.5%

*On June 14, 2016, the CB RF refinancing rate was 10.5%

We also point out that statutory interest accrued by default for a monetary obligation in accordance with Article 317.1 of the Civil Code, the taxpayer shall treat in accounting as non-operating income (expenses) in the determination of the tax base for corporate income tax. This position is held by the Ministry of Finance in a letter dated December 9, 2015 N 03-03-RH / 67486. Thus, starting from the first day of arrears, the creditor must begin to recognize the non-operating income and take it into account as part of such income at the end of each month of the respective reporting (tax) period, regardless of the date (dates) of payment provided for under the contract.

Current changes

Currently, a bill is under consideration which proposes that accrual of interest under art. 317.1 of the Civil Code on the amount of a monetary obligation is necessary only if this is specified in the contract or law (now a creditor has the right to receive such interest on commercial transactions in any case). After the completion of the approval process it is expected that these changes will come into force as of August 1, 2016.

Our recommendations

A survey conducted by us among middle-sized companies showed that many companies have adapted to the new requirements of “statutory interest”, and included in their contracts a provision on the non-applicability of Article 317.1 of the Civil Code in order to eliminate the risk of being charged tax on statutory interest. For those companies who have not yet had time to do that, we recommend adding this provision, both in new and in already existing agreements (with the proviso that the non-applicability of Article 317.1 of the Civil Code extends to relations between parties arising since June 1, 2015).

Our Contacts

- +7 495 225-30-38 Moscow

- +7 812 244-75-49 Saint Petersburg

- +7 495 225-30-38 Tver