- Awara

- March 3, 2014

- 4728

Press Release: Research on the Effects of Putin’s Tax Reforms 2000-2012

Awara Publishes Research on the Effects of Putin’s Tax Reforms 2000 – 2012 on State Tax Revenue and GDP.

- Russian state tax revenue increases 15-times in 12 years skyrocketing from 49 billion USD in 1999 to 743 billion USD in 2012

- Introduction of the liberal 13 percent flat tax on personal income resulted in a 15-times increase of income tax revenue from 5 billion usd in 1999 to 76 billion 1999

- Russian GDP up tenfold, 1000 percent, since Putin took office in 2000

- Russia has achieved Putin’s 1999 goals of catching up in terms of GDP with European countries

- Awara’s research shows Russia has the lowest taxes on payroll (labor) of all major economies

- Awara’s research shows that the method of expressing GDP as “real GDP in constant prices” is flawed

Related Press Releases:

- Awara to publish a book on Taxation in Russia – Awara Russian Tax Guide

- Awara Releases Global Tax Survey – Awara Global Survey on Total Payroll Taxes 2014

After Vladimir Putin became president in 2000, Russia embarked on an ambitious reform of the country’s then deplorable tax system. Today, the tax reform stands out as the prime example of Russia’s success during the 12 years of reforms. The tax reform spearheaded by Putin means that Russia enjoys Europe’s most liberal system of taxation. Currently Russia has transparent tax laws and internationally low tax rates, which provide good incentives for hard work. The corporate profit tax rate is 20 percent, and, in taxation of personal income, Russian residents enjoy a record low 13 percent flat tax rate for all income brackets.

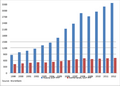

In 1999, before Putin first became president and prior to the onset of the tax reform, Russia’s total state revenue equaled 49 billion USD. In 2012, this figure had snowballed into 743 billion, representing an increase of more than 15 times in 13 years.

In 1999, the Russian state collected a mere 9 billion USD incorporate profit tax, but in 2012 the country raked in as much as 76 billion USD, an increase of more than 8 times compared to the year prior to the onset of reforms.

The introduction of the 13 percent flat tax on personal income in 2012 resulted in a 15-times increase of revenue on this tax to 76 billion from the 5 billion of year 1999.

Revenue on various sorts of taxes on natural resources filled state coffers with 79 billion USD in 2012, whereas the corresponding figure for 1999 was a mere 2 billion.

In the same period since Vladimir Putin first took office in year 2000 and largely due to the tax reform, Russian gross domestic product (GDP) in dollar terms has increased tenfold. At end of 1999 Russia’s nominal GDP was in US dollar terms 196 billion. By the end of 2012, the nominal GDP had risen to two trillions and 15 billion (2,015 billion), in other words a growth of more than 1000 percent in 12 years.

Expressing the GDP in PPP, the Russian economy grew from 870 billion USD in 1999 to 3,373 in 2012. By this measure, in 2012 Russia became Europe’s largest economy and the 5th largest economy in the world after the USA, China, India and Japan. In 1999 the GDP PPP per capita for Russia was 6,787 USD, while those in the comparison were: Portugal – 17,393, Spain – 21,009, UK – 23,784, France – 24,731. (Figure 19). By 2012, Russia had reached 23,501 per capita GDP measured in PPP. Thus Putin had realized even the most ambitious goal of catching up with the GDP levels that prevailed in 1999 in the leading Western nations. Russia’s per capita income now stands at less than half the level of the UK, while the gap in 1999 had measured 3.5 times.

Awara’s research exposes the flaws in measuring GDP “constant prices”, also falsely termed “Real GDP”. This is quite a misconceived method because it attempts to remove the effects of price inflation from the nominal GDP with a restatement of GDP expressed in the current year’s market prices by recalculating them with prices from a preceding year – the base year. The idea is that by the use of a so-called GDP deflator, which matches the prices to the base year prices, one would arrive at a measure of real change in economic output free from inflation. By doing so, this recalculation would yield something the economists want to call a “real GDP”, which would reflect only differences in output volume from year to year. But this is quite a remarkable undertaking to start with, because the GDP, gross domestic product, is by definition the market value of all (final) goods and services produced within a country. If you remove market values from the equation, then the result is not GDP any more but something else.

Awara’s global survey on payroll taxes shows that employees receive net in hand salaries that are only a fraction of what the employer must shell out on payroll. On average, taking an income level of 60 thousand euro p.a., the employer must pay 1.8 times the amount that is actually received by the employee. In the countries with the most punitive labor taxes, the employee’s take-home pay is only 40-43 percent of what the employer pays (Belgium, France and Italy). The survey found that of the world’s major economies, labor taxes are the lowest in Russia. You can read more about this in our press release on Awara Global Survey on Total Payroll Taxes here.

This research on the effects of Russia’s tax reforms 2000-2012 on state tax revenue and GDP is carried out in connection with the publication of the Awara Russian Tax Guide. Click here for the press release on the publishing of the Awara Russian Tax Guide.

How to Buy Awara Russian Tax Guide:

For inquiries about buy Awara Russian Tax Guide, please, contact:

publications@awaragroup.com

+7 495 225 30 38

The book can also be ordered on Ruslania website (that is one of the largest whole sellers and distributors of Russian books and periodicals). Click here to buy the E-book and here to buy a printed version.

In this connection, Awara also publishes its global tax survey: AWARA GLOBAL SURVEY ON TOTAL PAY-ROLL TAXES 2014.The survey shows how Russia has the lowest payroll taxes of all major economies in the world. Click here for the press release on the Awara Global Survey on Total Payroll Taxes.

ABOUT Awara:

Awara is a leading foreign owned business administration services provider on the Russian market, serving international and local organizations and individual entrepreneurs. Our services comprise a wide array of advisory for strategic business development, establishment and investment, and the implementation and execution of our advice; covering all areas of:

- Accounting

- Audit

- Tax Compliance

- Tax Advice

Contact Details:

Awara

info@awaragroup.com

Global call center: + 7 (495) 225 30 38