- Eugene Isaev

- November 7, 2018

- 695

Questions to Consider When Financing a Russian Company (Business Operation)

This article discusses issues which should be taken into consideration when planning the financing of a Russian business. In the long-run, the financing would certainly have to happen through profitable operations, but here we present other options until that point is reached.

LIST OF CONTENTS:

- Financing through share capital injections

- Contributions to assets

- Interest on borrowed funds, deductibility

- Thin capitalization rules

- Transfer pricing rules

1. Financing through share capital injections

The first option for financing a company is always through equity, share capital. But that is not always the best option, especially when the question is about financing a wholly owned subsidiary. There is also the question of profit tax and tax on dividends, which must be paid before the equity can be returned with a yield.

In Russia, there is additional complication with equity financing as a company is not allowed to have net assets below the value of nominal share capital. We will start with looking at this issue below.

Net asset value to charter capital ratio

Before we delve into the financing options, we need to make you aware about the question of required net asset value in proportion to share capital.

The law requires that a company’s net asset value must always be greater than the company’s nominal share capital (after the two first years from company registration). If there are cumulative losses (negative retained earnings), that is, the company’s charter capital is greater than its net asset value at the end of the second financial year and each subsequent year, the company must either be liquidated or its share capital must be decreased down to an amount equal to its net asset value. (In no case can the share capital be less than the minimal 10,000 rubles). The liquidation may also be initiated by the tax office.

Thus, making additional contributions to the charter capital requires keeping net asset value at a level of at least that of the new charter capital amount. This then would require that the company makes profits from operations, or that the problem is cured with a contribution into assets.

2. Contributions to assets

The problem with the net asset value is obviously best taken care of by ensuring profitable operations. In lieu of that, the company must undertake some actions to increase the net assets. One such method is by way of making a so-called ‘contribution into assets.’

A ‘contribution into assets’ represents a gratuitous contribution and unlike a contribution to share capital will not alter the nominal share capital. Therefore, the use of such contributions would not alter the share capital.

The contribution into assets method can therefore be used for curing the net asset gap. But as the money thus received is expensed (in the absence of profit) there will again be a negative asset gap, which will again require a new contribution, etc.

The company charter must provide for such obligation.

3. Interest on borrowed funds, deductibility

The Russian law recognizes as deductible the interest paid on any debt liabilities, regardless of their form, be it bank loans, trade and commercial credits, securities, other loans or borrowings. (Tax Code article 269). There are no restrictions on interest deductibility when the parties to the borrowing are unrelated parties acting on arm’s-length basis. (This starting 1.1.2015). There are however, restrictions on interest deductibility on controlled transactions (transactions between two enterprises that are related/affiliated enterprises with respect to each other, and other qualification criteria, as determined by Russian transfer pricing rules).

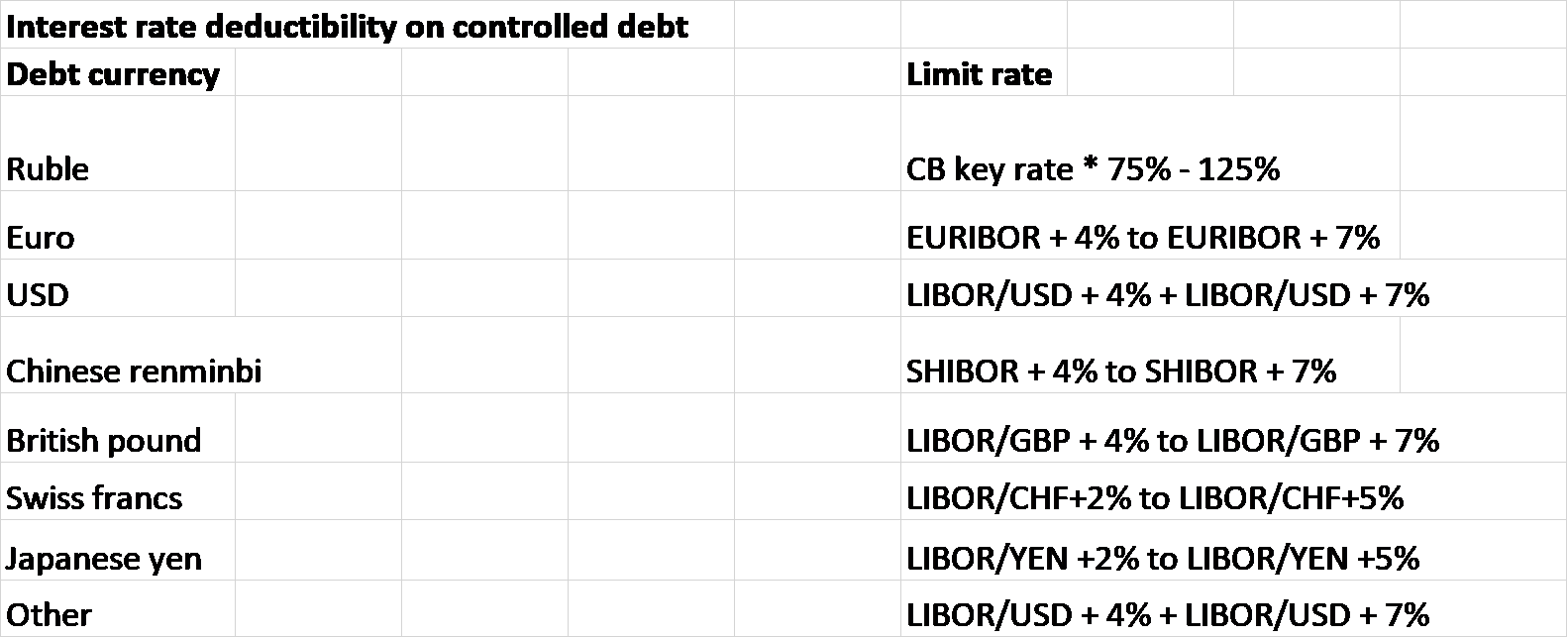

For full deductibility, interest on controlled loan transactions must fall between the range of a minimum and maximum limit set in the law. The limits are set for ruble loans as a percentage of the Russian Central Bank’s key rate (presently 7.5%) and for foreign currency loans as a percentage of a relevant benchmark rate, as shown in below table.

The actual interest is accepted for taxation when it falls between these limits, but otherwise it will be reexamined based on the transfer pricing rules.

The lower limit in those ranges is there for the purpose of setting the corresponding acceptable income of the other party to the transaction, the lender.

4. Thin capitalization rules

When considering financing a Russian entity through intra-group loans, one must also consider the so-called thin capitalization rules. The rationale for the thin capitalization rules is the aim to prevent foreign companies from evading payment of profit tax by repatriating profits from Russian subsidiaries in the form of excessive interest on debt instruments instead of taxable dividends (Tax Code, article 269). Indeed, since interest is deemed to be a deductible expense for a Russian borrower, it may reduce the tax base for profit tax, whereas dividends may not. Moreover, as a rule, dividends are subject to source tax in Russia, which means that the Russian subsidiary is required to withhold profit tax upon payment of dividends.

Interest is therefore a more advantageous form of repatriating profit for taxpayers than dividends.

The thin capitalization rules apply to a Russian corporate borrower if (a) there is direct/indirect foreign participation (including through affiliates, related persons, Russian or foreign) in the capital of such borrower and (b) the controlled debt-to-equity ratio of such borrower exceeds 3:1 (12.5:1 for banks and leasing companies). The scope of related persons includes not only Russian but also foreign companies which have (a) a participation of more than 25% directly/indirectly or more than 50% in each subsequent company or (b) a more than 25% common direct/indirect participant (“sister” companies). Interest on loans from independent banks are exempted from the rules (provided the debt – both principal and interest – was not repaid by a foreign shareholder or its affiliates as a result of execution of a guarantee to the bank). Loans provided exclusively within Russia are not controlled (provided certain requirements are met).

The rules envisage (a) to limit the interest deductibility by a maximum interest amount, and (b) to impose a dividend withholding tax on the interest in excess of maximum interest.

In order to calculate the maximum interest amount (a) all controlled debts are aggregated, and (b) calculation is made at the end of each reporting period discretely (i.e., with no subsequent changes, even if the equity amount is increased in the subsequent reporting period).

5. Transfer pricing rules

Russia first enacted transfer pricing legislation in 2011, which came into force from 1 January 2012. The Russian transfer pricing rules were modeled on the guidelines of the Organisation for Economic Co-operation and Development (OECD) taking also into consideration global practice. This legislation provides the criteria for determining related parties and controlled transactions, and acceptable transfer pricing methods to determine prices and profitability based on arm’s-length principles; the law also sets the reporting requirements and lists the allowed data sources and compliance requirements. There are however important differences in the Russian laws, and therefore corporations should ensure they liaise with relevant Russian tax advisors to ensure compliance.

Since 2014, all cross-border related-party transactions are subject to transfer pricing regulations, notwithstanding their value. This means that starting from 2014, these rules affect all international companies conducting transactions with their Russian subsidiaries and other related companies in Russia. In particular, all financing and loan transactions, royalty and licensing agreements, and supply and service agreements between Russian companies and their foreign related parties fall under these regulations even if these transactions have a zero value.

Hereby, it is worthwhile noting that the Russian tax authorities are already actively trading notes and sharing their experience with their foreign counterparts based on relevant treaties. The relevant Russian authorities actively participate in international TP conferences and roundtable discussions, which have helped them to fully integrate them with their colleagues and share their experience.

Analyzing transactions and preparation of transfer pricing documentation is a necessary precondition for effective preparation and filing of reports to tax authorities. Considering the deadline for filing the reports, it is a good idea to start their preparation in due time. Clients are advised to contact Awara Accounting for assistance on drafting relevant transfer pricing documentation (if it such has not been previously made), or to update to do an annual update on the transfer pricing documentation.

Please note that failing to submit, or submitting the controlled transactions report after the deadline, as well as providing reports with inaccurate information, may result in fines for the company. Furthermore, if the prices applied in controlled transactions do not conform to market prices, tax authorities may add to a taxpayer’s taxable income the revenue that the taxpayer would have earned if correct pricing had been applied (tax adjustments). If a tax check reveals understated taxes for transactions a company may face a penalty to the amount of 40% of the unpaid tax.

Read more about transfer pricing here.

Reporting requirements on Transfer Pricing

As per a new law from 2017, Russian companies, which are members of an international group of companies (if total annual group revenue is over RUB 50 billion, approximately $750 million) are now (applicable to financial year 2017) required to prepare a three-tier transfer pricing (TP) documentation. The obligations include a Country-by-Country (CbC) report, global and national documentation (from financial year 2018), as well as a notification on their membership in an MNC. These new requirements did not abolish previously enacted TP documentation requirements, those remained in force and the new rule will supplement them.

The notice of participation in an international group of companies must be submitted within 8 months of the end of the financial year following the year in which the group turnover exceeded RUB 50 billion rubles.

The three-tier (3-level) transfer pricing reporting includes:

-

A country-by-country report

This report must be submitted at the request of tax authority. The tax authority must give the company at least 3 months for complying with this request.

If the Russian company is a parent company of an international group (or an authorized member), then this report must be submitted within 12 months of the end of the financial year.

Companies are released from the obligation to submit a country-by-country report if such a report on the group is duly submitted to the relevant authority in a country with which Russia automatically exchanges information (considering detailed requirements listed in the law).

-

Global documentation (Global file)

This document is to be provided at request of the tax authority. The submission cannot be mandated earlier than 12 months and not later than 36 months from the end of the financial year.

-

National documentation (Local file)

This documentation is to be submitted at the request of tax authority. The submission may not be mandated earlier than 1 June of the year following the year when the controlled transaction took place. According to transition period rules, the tax authority may not request the documentation for 2018 and 2019 no earlier than 31 December 2019 and 31 December 2020, respectively. (However, the provisions on the transitional period will not cover documentation submitted under Article 105.15.1 of the Tax Code).

The new law will add to the previously enacted TP reporting requirements, which also remain in force. (Tax Code, article 105.15).

Awara Accounting – Transfer Pricing advice and assistance

Awara Accounting is pleased to provide your company with a full cycle of services related to ensuring compliance with the Russian transfer pricing rules.

Our Transfer Pricing practice group consists of competent experts covering the various specializations in the field of transfer pricing rules. Awara has supported numerous foreign multinational groups of companies in their transfer pricing matters in Russia right from the beginning when TP rules were first enacted.

Awara offers:

- To analyze company transactions to identify those that are subject to transfer pricing rules

- Advice on an effective transfer pricing strategy to safeguard your operations from tax risks and to set up a transfer pricing policy to ensure effective cash and goods / services flow within your group

- Assisting with structuring of intragroup transactions to ensure the arm’s length principle

- Drafting of transfer pricing documentation

- Adapting global TP policies to the Russian requirements

- Preparing and assisting with filing reports on controlled transactions to the tax authority

- Substantiating the methodology used and confirming the arm’s length level of current prices

- A special review of transfers of intellectual property rights and financial transactions

- Assisting in the establishment of retail and procurement structures

Our Contacts

- +7 495 225-30-38 Moscow

- +7 812 244-75-49 Saint Petersburg

- +7 495 225-30-38 Tver